20/09/2023

We recognize that genuine transformation extends further than mere superficial alterations. It constitutes a profound and intricate journey, and this remains particularly applicable within the contemporary insurance sector.

Driven by consumer expectations, technological advancements, and competition, the industry is on the verge of unprecedented change. The urgent need for digital transformation echoes through corporate boardrooms, representing a defining moment filled with critical trends, challenges, and opportunities.

To fulfil this ambitious need, the industry must ask and answer critical questions that will provide insights into a new paradigm that could be the key to unlocking true transformation.

The insurance industry finds itself at a critical—and potentially risky—juncture. This critical moment is often framed in terms of “digital maturity,” which refers to an organization’s ability to effectively use digital technologies to improve performance and innovate while also transforming business models, processes, and organizational structures. The road to achieving this maturity is filled with challenges and opportunities, requiring insurers to think strategically across multiple dimensions.

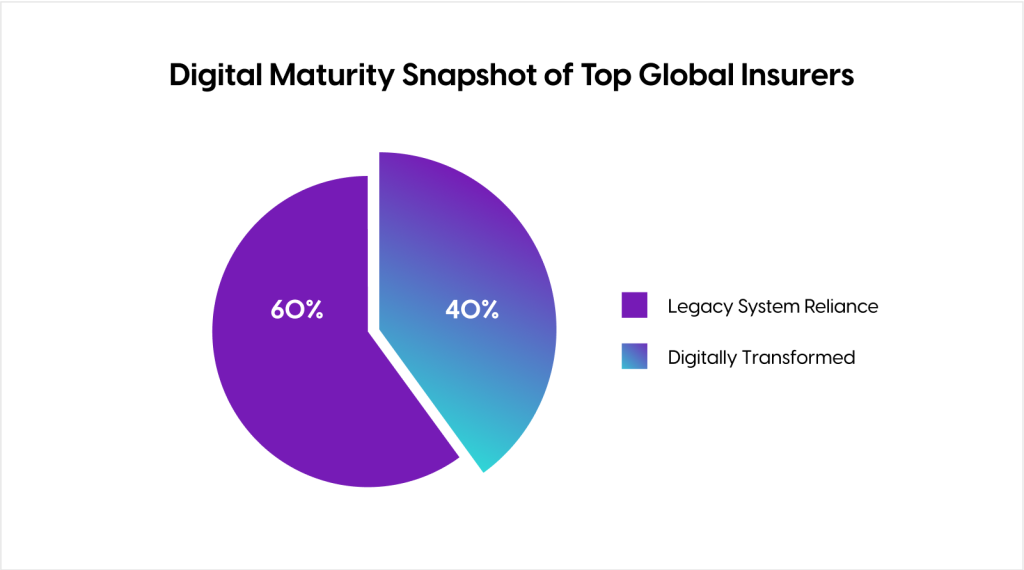

One of the pivotal changes reshaping the industry is the concept of consumerization. Today’s insurance buyers aren’t just influenced by their interactions with insurance companies; their broader online experiences set their expectations. This fundamental shift in insurer-customer interactions is supported by a 2020 study, which revealed that 40% of insurers are still in the early stages of substantial digital transformation (Insurer Digital Strategies).

Moreover, in our interconnected digital age, ecosystem integration has become crucial. More is needed for insurers to focus solely on improving internal information exchanges. They must also seamlessly integrate with a broader ecosystem, including partnerships, alliances, third-party providers, and vendors. The increasing importance of these external relationships is underscored by findings from the ACORD Insurance Digital Maturity Study, which indicate that among the top 100 global insurers, only 40% have comprehensively digitized their value chains.

The data and analytics role is adding further complexity. The industry has invested heavily in gathering and analyzing data, but the real challenge is using it effectively, especially when making crucial decisions. This is exemplified by the fact that only less than a quarter of the 200 largest global insurers have fully embraced digitalization.

Against this backdrop, the race toward digital maturity in the insurance industry appears less like a sprint and more like a marathon—requiring technological upgrades and a comprehensive overhaul of existing operational structures. This is not merely an academic point; companies leading in digital maturity have seen more than a threefold increase in share prices, while those lagging have experienced investor returns less than half the average over a decade.

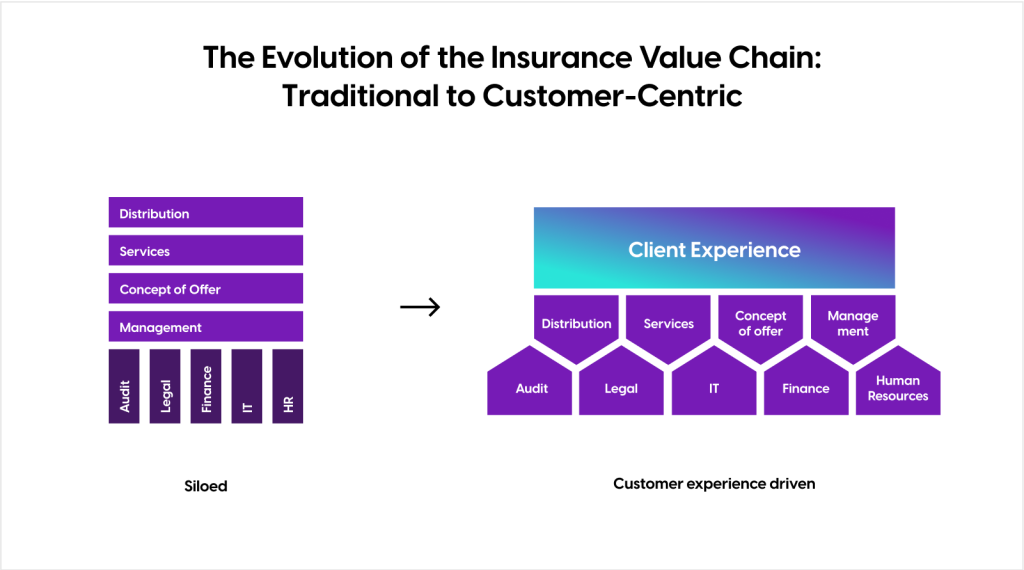

While diving deeper into Digital maturity, it becomes evident that an organization’s ability to harness digital technologies is closely intertwined with its capacity to create a Customer-Centric Value Chain.

The insurance industry’s transformation is not solely focused on implementing new technologies. Instead, it is about refocusing the entire value chain to prioritize the customer. This change is now a necessary strategic move, especially with the rise of digital interactions as the norm. The ACORD Insurance Digital Maturity Study serves as a stark reminder of this new reality; from 2015 to 2020, the percentage of global consumers interacting with insurers through digital means roughly doubled. With this trend showing no sign of slowing down, insurers must ask: can they afford to miss out on this digital shift?

Digital transformation is the cornerstone that holds these strategic imperatives together, offering insurers the flexibility and adaptability to seize opportunities at critical moments. Whether it’s a customer trying to bind a policy, an opportunity to cross-sell, or filing a claim, digitization ensures that the right processes and capabilities are in place when they matter most. It’s not just about gathering data but ensuring it is leveraged at the optimal place and time to create strategic advantages.

This brings us to the profound transformation underway in the traditional insurance value chain. Gone are the days of siloed functions and heavy internal processes. The focus is now squarely on the customer experience, pulling technological advancements from big data and AI to blockchain and IoT. These technologies are not merely add-ons but integrated into a cohesive system to enhance every facet of customer interaction—policy contract administration, claims processing, risk management, or fraud identification and mitigation.

The customer-centric value chain is a harmonized approach, allowing insurers to navigate the complex interplay between traditional operations and the growing demands of digital transformation. It’s a shift that’s more than just a trend; it’s an imperative. Insurers are no longer competing with direct competitors but with the entire spectrum of consumer experiences shaped by other industries. Those ready to lead in this customer-centric evolution are not just adapting; they are shaping the industry’s future.

As the digital landscape has witnessed an avalanche of transformation initiatives across industries, signalling a profound shift in how businesses operate, not all of these changes have proven to be successful.

The results tend to differ due to different factors like how well the changes align with the company’s goals, the leadership’s role, how flexible the company is, and how they use technology and IT systems effectively. So, determining whether a digital transformation initiative is truly successful or not can be due to different reasons.

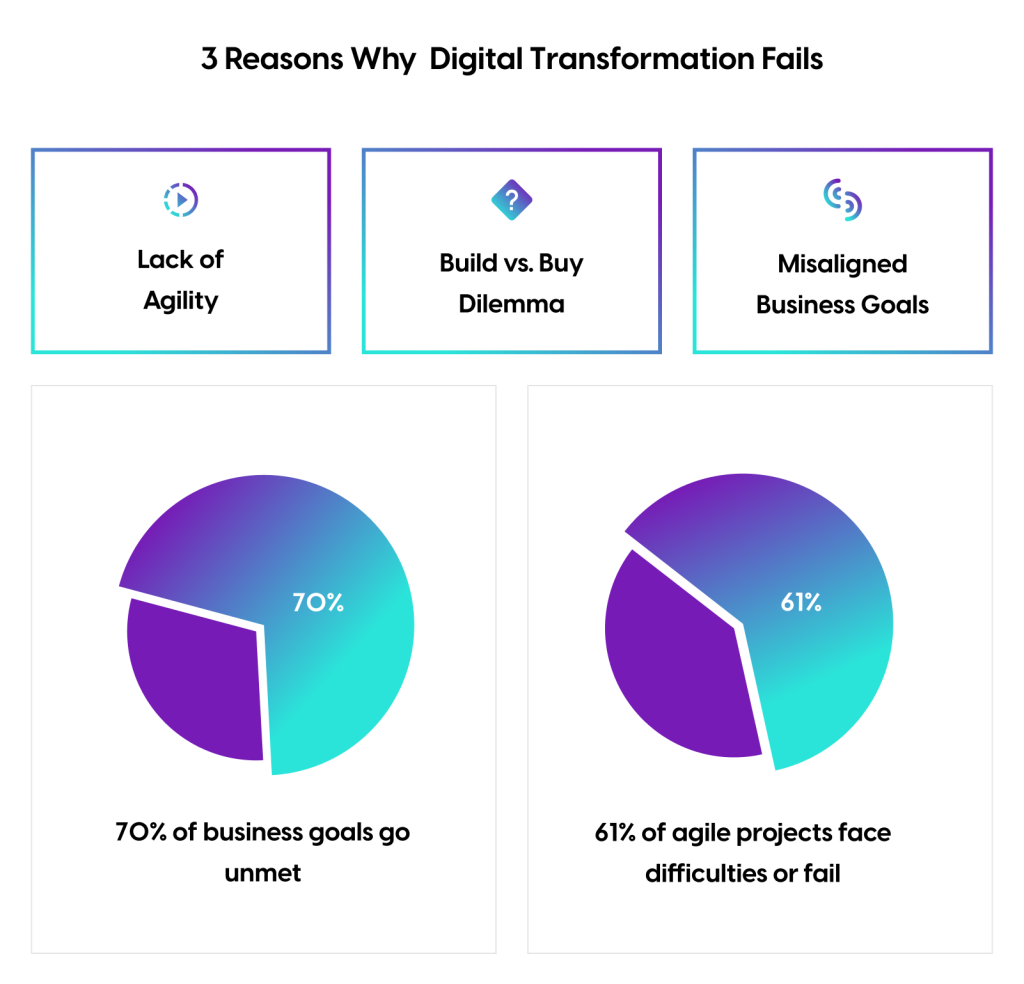

While the need for digital transformation in the insurance industry is clear, the path to achieving it is fraught with obstacles. A staggering 70% of digital transformation projects in the sector fail, according to a 2022 McKinsey study involving over 2,000 CEOs. This alarming statistic highlights the numerous and complex barriers to successful transformation.

One of the most prevalent obstacles is the need for agility. Though agility is highly extolled in project management circles, executing it successfully is easier said than done. A study by the Standish Group reveals that a significant 61% of agile projects face difficulties or fail outright. It’s not just about adopting agile methodologies like Agile or Scrum; it’s about implementing these approaches effectively within the existing, often fragmented, IT landscape. The challenge involves time constraints, skill sets, and financial considerations. True agility requires a mindset shift toward end-to-end process logic, open communication, and a culture of continuous improvement.

Another major hurdle is the ‘Build vs. Buy Dilemma.’ Insurers are often caught between developing bespoke solutions and opting for off-the-shelf platforms. While each option has its merits, the challenge lies in integrating these solutions with legacy systems, overcoming staff resistance, and bridging communication gaps between IT and business teams.

Misalignment with business goals adds another layer of complexity. Boston Consulting Group study indicates that 70% of digital transformations fail to meet their objectives. This misalignment often stems from poor anticipation of organizational needs, setting overambitious deadlines, and needing to sufficiently onboard employees to new processes and technologies.

In summary, the high failure rate in digital transformation projects results from technological challenges and a complex interplay of methodological, technological, and strategic factors. Achieving successful digital transformation is not merely about adopting new technologies; it’s about orchestrating a nuanced blend of methodological adaptation, technological integration, and alignment with well-understood business goals.

Navigating the challenging path to digital maturity requires caution and a willingness to learn from past failures. Having analysed the pivotal questions surrounding the digital transformation needs of the insurance industry, one solution stands out: the adoption of Low-Code No-Code (LCNC) platforms and empowering “Citizen Developers” within the organization. These individuals, often with deep domain expertise, can create meaningful applications without formal coding skills, relying instead on business logic and drag-and-drop functionalities. Utilizing LCNC platforms, Citizen Developers enable organizations to identify operational inefficiencies, enhance customer experiences, and discover new revenue streams without stepping out of their primary business roles.

As the tides of technology continue to rise, organizations are finding more of their non-technical staff turning into Citizen Developers. Gartner reports that approximately 41% of non-IT employees are already involved in crafting or modifying technological solutions. This is not a fleeting trend but a reflection of the ongoing democratization of technology.

Industries like insurance face unique challenges and require specific solutions for scalability and effectiveness. LCNC platforms can be customized to meet these needs, especially when designed for the industry. Veggo is a vertically integrated LCNC platform created with the insurance sector in mind. Developed with 25 years of VERMEG’s domain expertise, Veggo is a highly specialized tool that prioritizes customer-centricity, operational efficiency, and adaptable IT systems. It enables the composability of enterprise-level solutions, making it an asset for the insurance industry.

In the ever-changing business landscape, a vertically integrated platform is more than just a technical solution; it’s a strategic advantage. Low-Code and No-Code solutions have emerged as powerful tools, offering efficiency and adaptability. Veggo, is low code/no code solution tailored to address the unique challenges of the insurance industry. With its deep expertise of the sector and an in-depth mastering of the entire insurance value chain, Veggo is positioned to empower insurers to tackle their most pressing issues and navigate the evolving landscape. Developed with 25 years of VERMEG’s domain expertise, Veggo is a highly specialized tool that prioritizes customer-centricity, operational efficiency, and adaptable IT systems. It enables the composability of enterprise-level solutions, making it an asset for the insurance industry.

Transitioning from the general to the specific, Veggo’s rich marketplace and integral features significantly elevate its utility, making it a powerful tool for businesses across various industries.

The tangible benefits of adopting such a specialized platform are extensive. Veggo enhances organizational agility, reduces time to market through streamlined workflows, fosters innovation by breaking free from legacy constraints, and amplifies operational efficiency— all while drawing upon decades of trusted industry-specific expertise from VERMEG.

In summary, LCNC platforms and Citizen Developers have the potential to revolutionize the insurance industry. Platforms like Veggo, which are specifically designed for the industry, offer solutions to current challenges and pave the way for sustainable, long-term success. The journey towards digital maturity may be complex, but with adaptable, industry specific LCNC platforms, the future looks bright for those ready to embrace innovation. It’s time to focus on putting the customer and their experience at the center and charting a new course for growth in the industry. This is not just about change but shaping a future that aligns with the core values of insurance.